Mahindra Group is aligning with the Task Force on Climate-related Financial Disclosures (TCFD) framework to ensure transparent reporting around governance, strategy, risk management, and metrics.

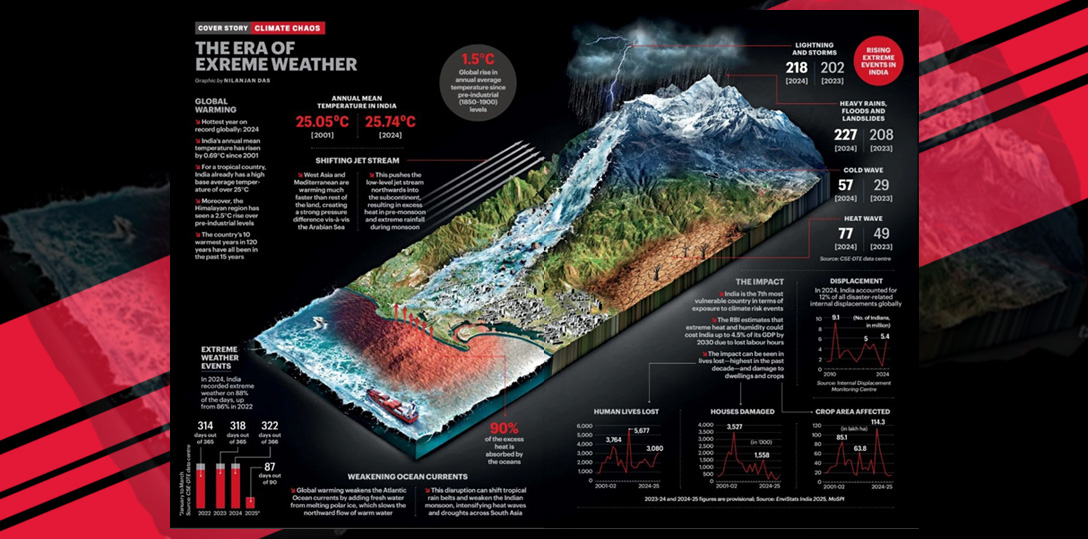

The global climate crisis is accelerating, with far-reaching implications for businesses, economies and communities. 2024 marks the first year in recorded history where average global temperatures exceeded 1.5°C – a critical threshold that amplifies extreme weather events and disrupts established climate patterns. Over the past 50 years, incidences of heavy rainfall days and cloud bursts have increased by 75% in certain regions, leading to devastating floods such as those in Himachal Pradesh & Punjab in 2023, which caused damages > ₹8,000 crore. At the same time, rising temperatures have intensified heatwaves, with heat indices reaching as high as 55°C in parts of Gujarat & Rajasthan, resulting in productivity losses and surging cooling demands.

For Mahindra Group, these risks are not abstract – they directly impact key sectors like agriculture, automotive, renewable energy, finance, etc. In agriculture, >55% of India’s cultivated area is rainfed, making it highly vulnerable to erratic monsoons and droughts. Severe dry spells in Marathwada and Vidarbha have repeatedly disrupted yields of key crops such as cotton, soybean, and sugarcane. Similarly, the automotive sector faces challenges from extreme weather events, with the 2015 Chennai floods causing damages of over ₹15,000 crore, halting production lines, disrupting supply chains, etc. – also, leading to the 2nd costliest insurance event in India’s history. Meanwhile, in renewable energy, rising dust levels have increased soiling losses by up to 30% in high-dust zones, while variability in wind gusts has damaged systems in western Rajasthan, escalating operational costs & impacting solar generation. Any significant climate event also typically leads to higher non-performing assets (NPAs) & delays in loan recovery for financial sector.

To address these systemic risks, Mahindra has been embedded climate resilience into its strategies across businesses. Mahindra Group overall is aligning with the Task Force on Climate-related Financial Disclosures (TCFD) framework to ensure transparent reporting around governance, strategy, risk management, and metrics. Mahindra Lifespaces integrates climate-responsive architecture and undertakes hydrological study to understand flood risks better. These initiatives, although anecdotal reflect Mahindra’s proactive approach to identifying & managing climate risks.

Building on this foundation, we continue to address climate risks through collaborative engagements and innovative tools. A recent NBFC Roundtable, "Driving Sustainability in the NBFC Sector", hosted in collaboration with Step Change, convened over 30 NBFCs and funds, representing ₹12 lakh crore in assets, to explore strategies for managing portfolio climate risks such as flooding, drought, and heatwaves alongside regulatory compliance. Discussions revealed that 80% of Indian states face climate risks, contributing to surging agricultural NPAs – 2.5 times higher than before – with 20-25% linked to climate-driven crop failures. The session also tackled challenges like financing carbon-intensive assets and complying with RBI-mandated climate risk disclosure frameworks, enriched by peer learning and case studies. At Mahindra Finance, this work is being actively institutionalized through tools like physical climate risk heatmapping, scenario analysis for risk forecasting, and vulnerability assessments for farm and equipment portfolios to reduce climate-related impacts on parameters such as crop yields, tractor usage, and asset valuations.

Complementing these efforts, the Climate Risk & Business Continuity session with AXA Climate brought together Sustainability Champions and cross-functional teams from across group companies to explore broader business implications of climate risks across manufacturing, agriculture, logistics, renewables, finance, etc. Participants gained actionable insights into resilience-building, infrastructure planning, and operational adjustments to address risks such as supply chain disruptions and asset devaluation. Equipped with tools for assessing sectoral vulnerabilities and developing tailored adaptation measures, attendees were provided implementation materials to guide action within their organizations.

By embedding climate resilience into operations & decision-making, we can aim to adapt to the challenges of a changing climate while ensuring long-term sustainability across our businesses.

Source: India Today

You can also share your thoughts in the Comments section below!