The Board of Directors of Mahindra & Mahindra Limited approved the financial results for the quarter and nine months ended December 31, 2021, of the Company and the consolidated Mahindra Group.

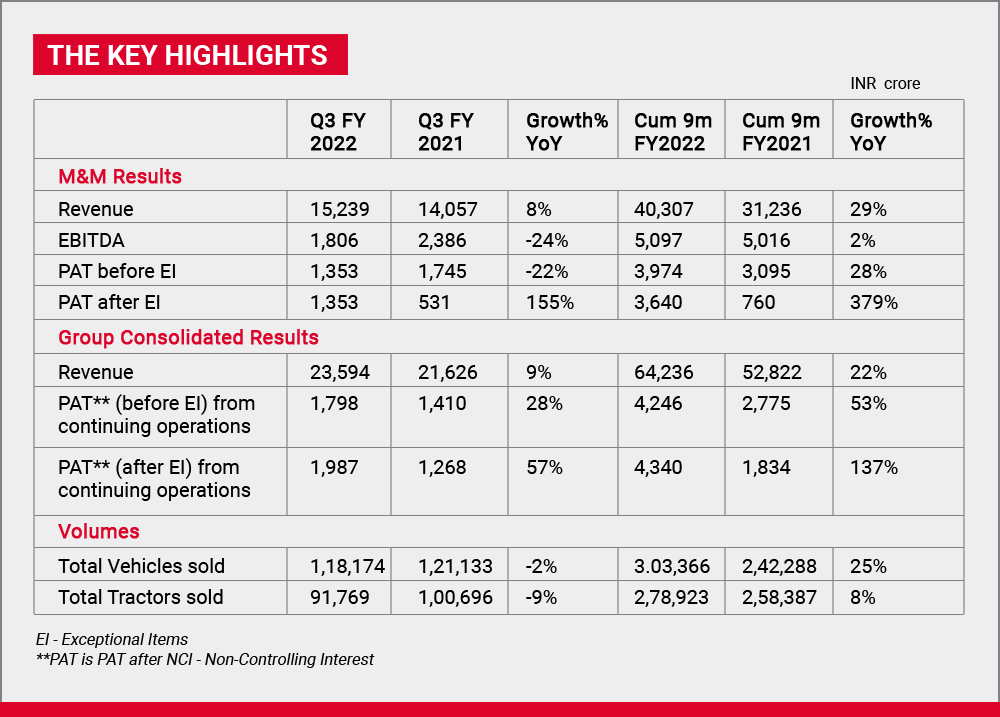

These are the highlights of the financial results:

- Commodity inflation, shortage of semi-conductors impacting operating margin, which stands at 11.9%

- Continued growth in exports, both for Auto and Farm

- Improved Group company performances at Mahindra Finance and Mahindra Lifespaces

Automotive

- A very healthy booking pipeline and buoyant demand for Mahindra’s products

- 155K plus total open bookings, out of which 70K plus are for XUV700

- Highest ever quarterly sales of Treo Auto and Treo Zor in the electric vehicle (EV) 3-wheeler segment

- Stringent cost control measures have helped partially mitigate the margin impact of commodity inflation

- Global shortage of semi-conductors / ECUs impacted production and sales for yet another quarter

- However, supplies improved over Q2 F22, reflected in higher volumes in Q3 F22 QoQ

Farm Equipment Sector (FES)

- Farm business delivered an excellent performance with the second-highest Q3 in terms of PBIT and domestic volumes

- Healthy growth of 1.4% in Q3 market share for M&M

- Code by Swaraj: A revolutionary farm machine launched on November 11, 2021, with industry-first features of adjustable ground clearance and bi-directional driving. It can be used for weeding, spraying, earthing up for horticulture crops and harvesting grains

What our leaders had to say

“We have seen improved performance across multiple businesses as reflected in our consolidated performance. Our Auto business has done well despite supply-side challenges while our Farm business has shown market share increase despite a slowdown in the market.”

- Dr Anish Shah, Managing Director and CEO, M&M Ltd.

“Demand for the entire automotive product portfolio remains strong. The order book for XUV700 and All-New Mahindra Thar reflects the customer and market success of these new launches. With better availability of semi-conductors, we hope to build the volume growth momentum in Q4 F22 in our journey to being No. 1 in core SUVs. FES gained 140 basis points market share YOY in Q3 F22 and delivered robust financial metrics despite market slowdown and steep commodity inflation.”

- Rajesh Jejurikar, Executive Director, M&M Ltd.

“Our focus on capital allocation and profitability has led to a steady increase in RoE over the last few quarters. We remain committed to delivering on our growth and return objectives.”

- Manoj Bhat, Group Chief Financial Officer, M&M Ltd.

You can also share your thoughts in the Comments section below!