Driving financial innovation and excellence in emerging India

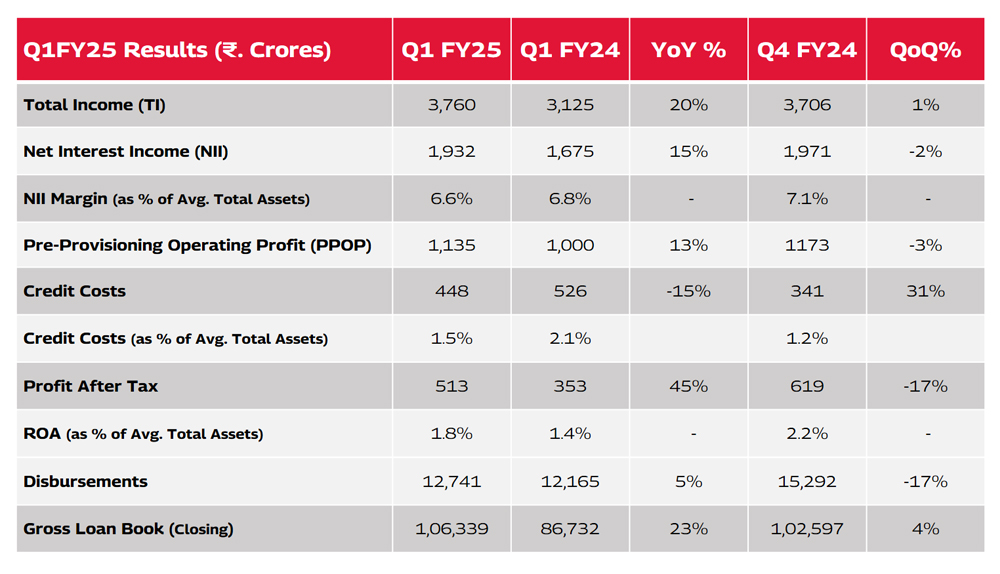

Mahindra Finance announced its unaudited financial results for Q1FY25, showing impressive growth. Business Assets grew 23% YoY to ₹1.06.339 Crore, and disbursements rose 5% YoY to ₹12,741 Crore. Collection efficiency stayed steady at 94%, with stable asset quality and Stage 3 assets at 3.6%. As one of the top financers in various vehicle categories, the company is also expanding into SME lending, LAP, and leasing, with the SME portfolio growing 68% YoY. Digital transformation remains a key focus, enhancing customer experience and asset quality. The company has also started offering life and general insurance policies through a new corporate agency license. Mahindra Finance's strong balance sheet includes a capital adequacy ratio of 18.5% and a liquidity chest of ~₹8,216 Crore.

Watch Dr. Anish Shah's statement on Mahindra Finance's Q1FY25 performance

Mahindra Finance is steadfast in upholding its brand recognition and value. The company consistently reinforces its commitment to integrity, transparency, and ethical conduct through strengthened measures in compliance, risk management, and governance.

You can also share your thoughts in the Comments section below!