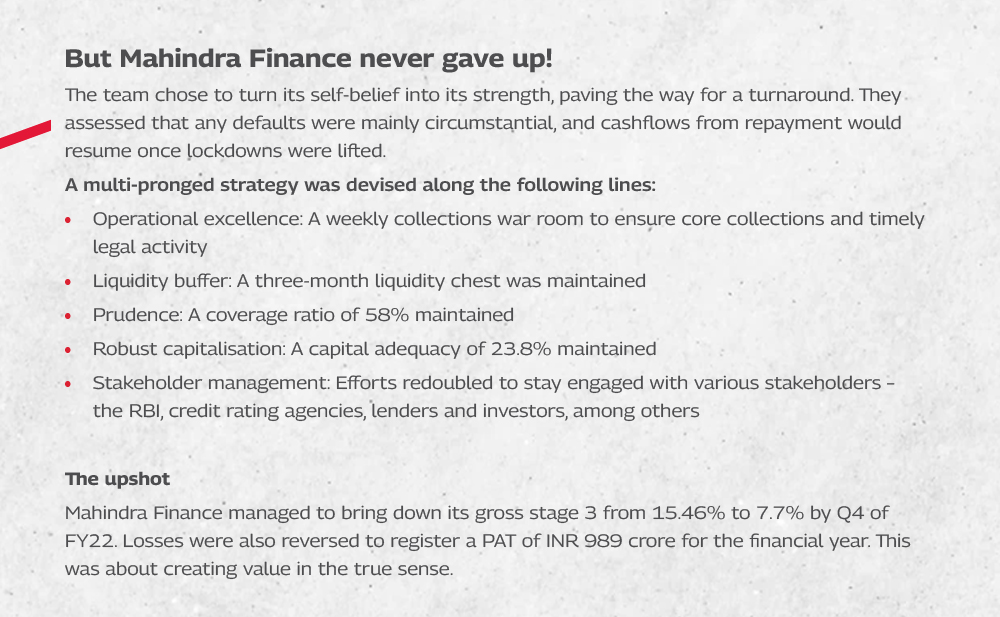

When the going gets tough, the tough get going! The Covid-19 pandemic was one of the most challenging phases of Mahindra Finance’s journey. Yet, its people demonstrated a ‘Can Do, Will Do’ spirit with entrepreneurial zeal, to make the business come up stronger and better than before. Read how Mahindra Finance created an ‘impact’ful business…

A crisis like never before

Covid-19 brought about unprecedented changes to the business:

- 15.46% gross stage 3 (loans overdue for over 90 days) in Q1 F22, a lifetime highest for the company

- Mounting losses

- 7% of employees tested positive

- 40% of working days were available

- 40% of branches were shut during the peak of the pandemic

This pandemic raised fundamental questions:

- Was the business model sustainable, going forward?

- Will core consumers in the taxi, tourist, transportation, and school bus segments stay viable in the near term?

- Will cash-based collection work in the ‘new normal’?

- Will vehicle repossession be possible given the restrictive operating conditions?

“The company has been able to report a satisfactory top-line and bottom-line performance on the back of growth in asset book and control on asset quality. We look forward to this momentum to continue in subsequent quarters.” Ramesh Iyer, Vice-Chairman & Managing Director, Mahindra Finance

Lessons learnt

- Sharply define the problem and challenges to be overcome

- Discuss with, and take into confidence, all stakeholders to co-create solutions

- Be open and flexible to workarounds and course corrections

- Build trust with employees, customers, and other stakeholders

- Stay balanced during stressful times, and maintain constant communication with teams

- Keep a focused approach, along with the rigour of follow-ups, to meet execution milestones

- Empower local teams for tactical calls.

You can also share your thoughts in the Comments section below!