Resilience, growth, and future-ready innovation unveiled in Q4 financial highlights

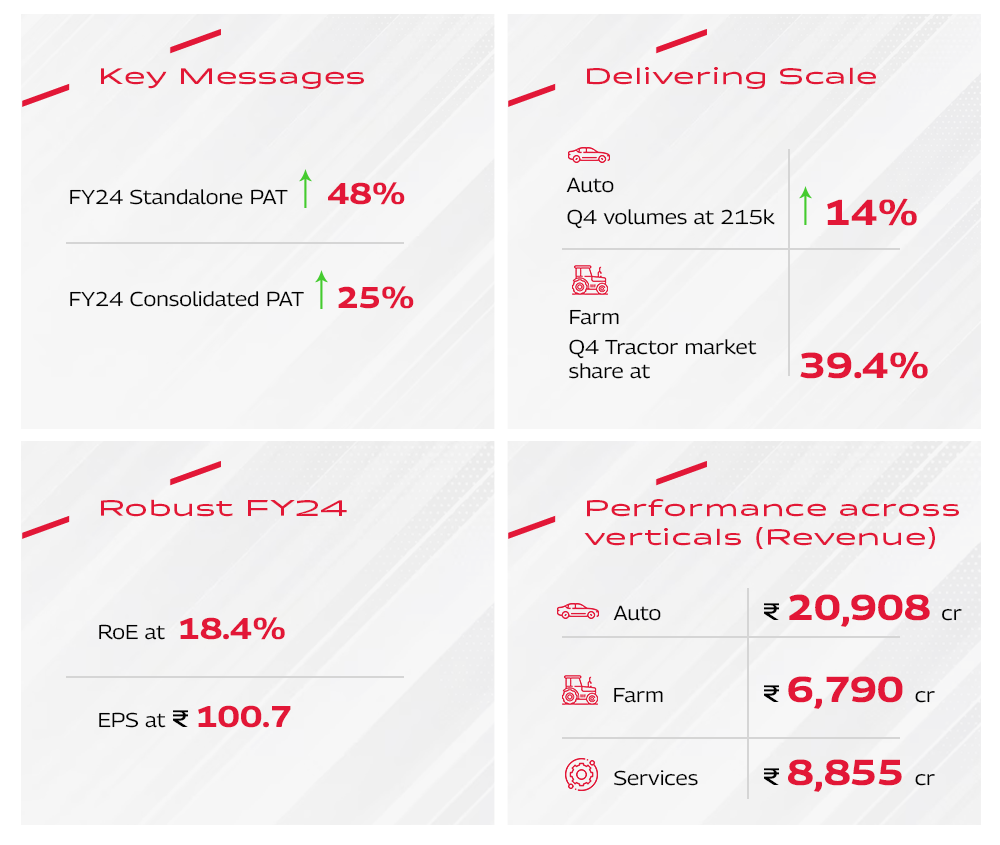

Mahindra & Mahindra's Q4 financial reports illustrate the company's resilience and growth amidst challenges, showcasing impressive numbers and strategic initiatives. Standalone PAT surged by a remarkable 48%, reaching ₹10718 Crore, while consolidated PAT climbed by 25% to ₹11269 Crore. Dividend is ₹21.10 per share, up 25%. Despite rural stress and tech challenges, Mahindra stayed committed to its purpose, achieving sustainability milestones like EP100 in Auto and 100% water positivity.

Notably, the company made significant strides in women empowerment, establishing skilling platforms. Moreover, robust market leadership was evident in the Auto and Farm sectors, with #1 positions in SUVs, LCVs, and tractors, along with revenue market share growth of 130 bps and market share gains of 350 bps and 40 bps respectively. MMFSL and TechM saw notable improvements, with MMFSL achieving its lowest-ever GS3 at 3.4%, and TechM's turnaround gaining momentum.

The Growth Gems initiative continued to shine, with LMM commanding a 58.7% share in electric 3 wheelers and MLDL witnessing a 2x increase in residential presales to ₹2328 Crore. With India's largest renewables InvIT listing and significant member additions and upgrades in Holidays, the Group remains steadfast in delivering value to shareholders and stakeholders alike.

For an in-depth understanding of the highlights, watch our leaders, Dr Anish Shah (Group CEO and MD), Rajesh Jejurikar (Executive Director and CEO, Auto and Farm Sectors) and Manoj Bhat (Group CFO) break down and analyse the Q4 FY24 results in the recording below.

You can also share your thoughts in the Comments section below!