The tipping point has come for businesses to adopt sustainable business practices so as to leave a better planet. This was the crux of Mahindra Group Chairman Mr Anand Mahindra's address at the World Economic Forum. Addressing the event virtually, Mr Mahindra also spoke about stakeholder capitalism and how the Mahindra Group had embedded purpose-driven capitalism in its business ethos, and the need to adopt the Group's philosophy of people plus planet for profits. Here are excerpts from his address at the WEF 2021.

Stakeholder capitalism

Purpose-driven capitalism or stakeholder capitalism or conscious capitalism all address the same problem statement - the massive erosion of public trust in large corporations and in their objectives. I believe the Occupy Wall Street movement was the tipping point. It revealed that there was an enormous credibility chasm between society and big companies and all our since then have been essentially towards bridging it.

Our Rise movement was inaugurated in 2011 but it actually began to incubate as far back as in 2007, even before the Occupy Wall Street movement. We were fortunate that a gentleman named Scott Guttsen, who runs an ad agency in New York and was doing an assignment for us at that time, alerted and sort of showed a mirror to us that our existing culture and our company held out the promise of our being at the vanguard of a movement that really united capitalism with purpose.

Rise is today the common philosophy that unites everyone at Mahindra Group. It mandates us to challenge conventional thinking and innovatively use all our resources to drive positive change in the lives of our stakeholders and the communities in which we work to enable them to rise. That is our unique version of purpose-driven capitalism and we take comfort in the fact that shaping of this purpose came well before purpose itself became mainstream.

People + Planet = Profit

We coined the equation as a way to respond to what we saw as a challenge to the whole movement of purpose-driven capital. The entire effort of doing well by society is something that people believed comes post the profit line and is some kind of tax on profit. Companies were seeing it as a box that must be ticked much as companies today create CSR campaigns as a mode of compliance.

I am skeptical about any intrinsic change in cultural behaviour if the mindset doesn't change. I have a practical approach to solving this problem. Purpose will truly come first when it is aligned to Adam Smith's assumption that people act out of enlightened self-interest. Purpose-led capitalism where enlightened self-interest aligns with community interest is the future of business. You will get genuine and enduring change only when companies recognise that businesses which address ESG (environment, social and governance) needs are actually the biggest and the most lucrative opportunities for profit over the coming next decade. Battling climate change, for example, is a USD26 trillion opportunity, or, products and services for people or communities living at the bottom of the pyramid which are going to see the highest consumption growth in the coming years. So doing business in a manner that makes people's lives better is about doing well, and doing good at the same time.

Communities and future consumers, who are essentially millennials and Gen Z's, are beginning to demand that companies rearrange their priorities towards achieving the Sustainable Development Goals. Communities and consumers would act as brakes on the excesses of shareholder-led capitalism by increasingly dictating the direction that businesses adopt. Interconnectedness of people with each other and the planet is non-negotiable and hence the equation people plus planet equals profit. Business leaders who fail to accept the new realities will be abandoned by consumers and society.

The WEFORUM discussion

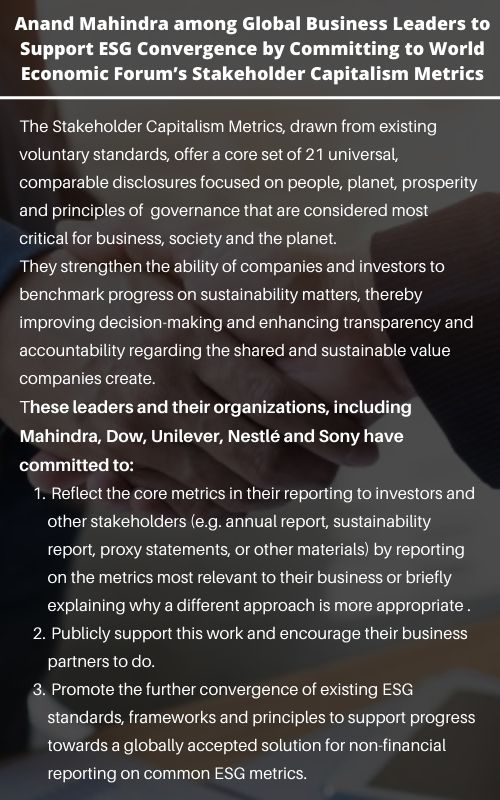

Benefits of adopting ESG metrics

I am an investor, a businessman and a member of the society as well - all rolled into one. As an investor I am well aware that the secret to successful investing is to ride the tide which is clearly running in favour of investments and enterprises which see themselves as part of a larger social picture. The Covid pandemic has shown us that welfare of society and business is actually linked to the welfare of its weakest member. Investors tend to look at proposals that will have a wider perspective and that will influence my decision as an investor.

As a businessman, I look at two factors: how do I grow my business sustainably and how do I meet the needs and aspirations of my consumers? India has 1.3 billion people and the middle and lower segments of the pyramid are a potential powerhouse of consumption.It is in my self-interest as a businessman to build businesses to improve the economic prospects of as many people as possible.

Millennials and Gen Zs, who are going to be the consumers of tomorrow. There is very strong evidence to indicate they are going to put their money and their custom behind these expectations. Being a 'good' business is going to be good for business. Communities are also playing a similar role. They are increasingly becoming vocal about which businesses they will welcome.

We are members of society and it is our responsibility to leave a living and working planet, and not some kind of a dystopian nightmare for them. The ESG metrics convert intent into action. The ESG are metrics important markers. They indicate our progress to leaving our planet a better place than we found it.

You can also share your thoughts in the Comments section below!